At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. Since 1988 it has more than doubled the S&P 500 with an average gain of +25.25% per year.

These returns cover a period from January 1, 1988 through December 6, 2021. Zacks Rank stock-rating system returns are computed monthly based on the beginning of the month and end of the month Zacks Rank stock prices plus any dividends received during that particular month. A simple, equally-weighted average return of all Zacks Rank stocks is calculated to determine the monthly return. The monthly returns are then compounded to arrive at the annual return. Only Zacks Rank stocks included in Zacks hypothetical portfolios at the beginning of each month are included in the return calculations. Zacks Ranks stocks can, and often do, change throughout the month.

Certain Zacks Rank stocks for which no month-end price was available, pricing information was not collected, or for certain other reasons have been excluded from these return calculations. The U.S. Department of Commerce last week announced that its third estimate for 1Q20 GDP growth was a rate of 6.4%. This was in line with the previous estimates and with the consensus outlook, and represents a robust recovery. The report also includes an inflation gauge, the PCE price index. We expect above-trend GDP growth for the next few quarters. Some segments of the economy are back to or above pre-pandemic highs.

These include consumer spending on durable and nondurable goods as well as investment into residential and intellectual property products. Other segments continue to lag, such as consumer spending on services, investment into structures, and exports. Analysts at the bank raised the price target of AAPL stock to $210 from its previous $180 target. Morgan isn't the only one making bullish claims for Apple as of late, either.

Morgan Stanley followed suit earlier this month, raising its price target to $200 per share. With that said, let's take a look at other AAPL stock price predictions. Analysts have forecast good things for the tech giant in the future. A majority have Outperform ratings for the stock and forecast a price increase. For example, Credit Suisse analysts have set a price target of $400 for its stock and stated that its revenue will grow by mid- to high-teens percentages in the next five years.

Its earnings growth will be even more striking, ranging from the high teens to more than 20%, "driven by share and ongoing share repurchases." Innovation may be hard to define but, to borrow from former U.S. Supreme Court Justice Potter Stewart, you know it when you see it. Manufacturing industries that dominated the economy decades ago - textiles, televisions, even automobiles, to a large degree - have moved overseas, where costs are lower.

Yet the U.S. economy, prior to the pandemic, had expanded to record levels. Healthcare industry is mobilizing to improve COVID-19 testing, treatments and, ultimately, a vaccine. A couple of statistics should help illustrate our point. GDP was approximately $1 trillion in 1930 but nearly $22 trillion in 2019.

Meanwhile, the U.S. population has grown less than 3-times during that time span, to 320 million from 120 million. The delta between GDP growth and population growth has been driven in large part by innovation. In addition, the value of listed corporations on U.S. stock exchanges at the end of 2018 was approximately $32 trillion, representing 41% of global equity market capitalization, while U.S. According to AllForecast's predictions, we're likely to see very low levels of volatility in two years' time. The monthly percentage changes are relatively consistent — although four months will see the stock price drop slightly, the overall trend is modestly bullish. It's unlikely to pave the way for the heights predicted for 2025 by AI Pickup, but it's still a significant increase from its current price of $117.03.

MarketBeat empowers individual investors to make better trading decisions by providing real-time financial data and objective market analysis. Healthcare industry is mobilizing to improve COVID-19 testing, treatments and vaccines. GDP was approximately $1 trillion in 1930 but nearly $22 trillion at the end of 2019. In addition, the value of listed corporations on U.S. stock exchanges at the end of 2020 was approximately $32 trillion, representing 41% of global equity market capitalization, while U.S.

The Technology sector started slowly in 2021 as investors focused on value stocks. The sector is the largest in the U.S. market and now accounts for more than 28% of the S&P 500. Over the long term, we expect the sector to benefit from pervasive digitization across the economy, greater acceptance of transformative technologies, and the development of the Internet of Things . Healthy company and sector fundamentals are also positive. For individual companies, these include high cash levels, low debt, and broad international business exposure.

We have an Over-Weight ranking on the Tech sector and think investors should look to allocate up to 30% of their diversified portfolios to the group. Here is how we use our analysts' Tech sector ideas in our Focus List and Model Portfolios. The U.S. Department of Commerce announced that its third estimate for 2Q21 GDP growth was a rate of 6.7%. The GDP report also includes an inflation gauge, the PCE price index. Looking ahead, we expect above-trend GDP growth for the next few quarters. But there may be bumps along the way, including the impact of the delta variant on jobs and consumer spending on services, as well as supply-chain bottlenecks.

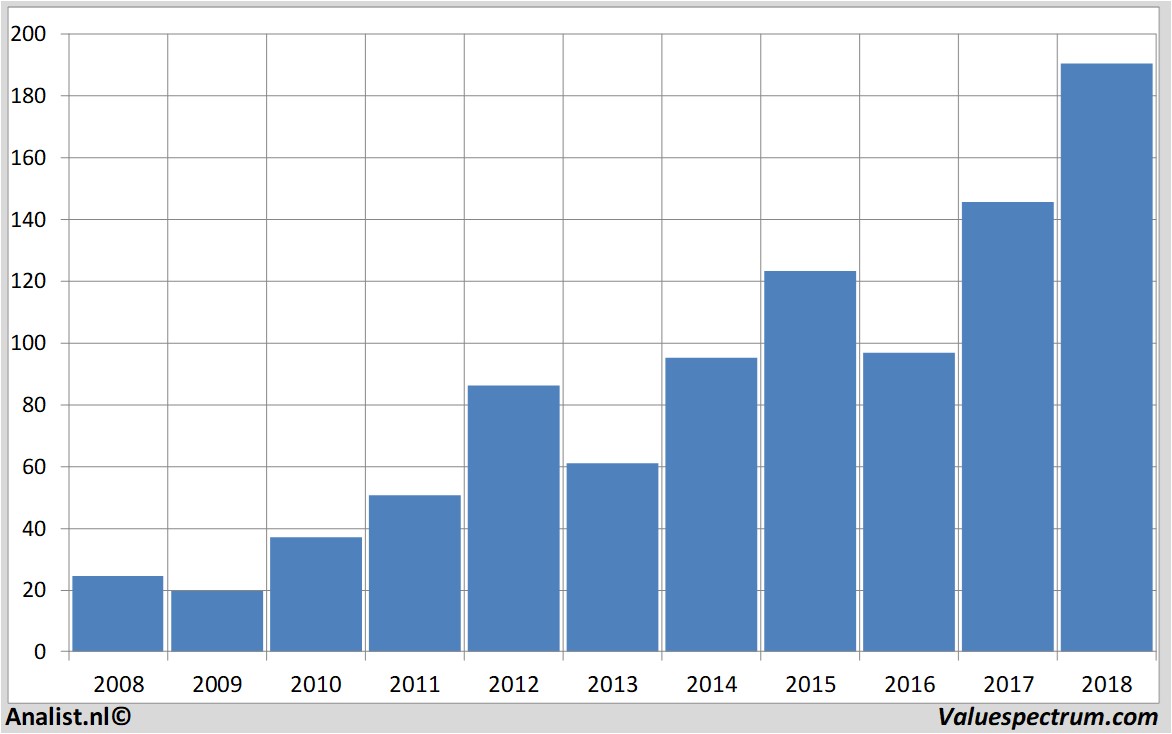

Speaking of the employment environment, unemployment claims rose last week to 362,000, according to the Labor Department. This was the third consecutive week of rising claims. Data by YChartsThis translates to over 3% of the current market cap. Should the stock repurchases continue at the same rate, the effective yield based on today's price would be over 3.5%. The share buybacks also provide an underlying support for the share price.

When shares dip, the company can provide a level of demand which will support the price. On average, Wall Street analysts predict that Apple's share price could fall to $172.10 by Dec 22, 2022. The average Apple stock price prediction forecasts a potential downside of 1.7% from the current AAPL share price of $175.08. Nothing in our research constitutes legal, accounting or tax advice or individually tailored investment advice. Our research is prepared for general circulation and has been prepared without regard to the individual financial circumstances and objectives of persons who receive or obtain access to it. Our research is based on sources that we believe to be reliable.

Some discussions contain forward looking statements which are based on current expectations and differences can be expected. Further, we expressly disclaim any responsibility to update such research. Past performance is not a guarantee of future results, and a loss of original capital may occur.

None of the information presented should be construed as an offer to sell or buy any particular security. As always, use your best judgment when investing. The U.S. Department of Commerce announced that its "third" estimate for the 3Q20 GDP rate of growth was 33.4%. This was in line with the previous estimates and with the consensus outlook, and represented a sharp spike higher from the 31.4% plunge in 2Q. After this reading, we expect that GDP reports going forward should settle into a low- to mid-single-digits rate. At $21.2 trillion, the U.S. economy at the end of 3Q was almost 3% below its pre-pandemic highs.

These segments consumer spending on durable and nondurable goods, and investment into residential and intellectual property products. Other segments continue to lag, such as consumer spending on services and investment into equipment. Manufacturing industries that dominated the economy decades ago - textiles, televisions, even automobiles to a large degree - have moved overseas, where costs are lower. Yet the U.S. economy, even during the pandemic, has expanded to record levels. If U.S. corporations weren't innovating, the domestic economy would not be growing and capital would not be flooding into the country. GDP was approximately $1 trillion in 1930 but nearly $23 trillion at the end of 1H21.

Meanwhile, the U.S. population has grown less than three-times during that time span, to 320 million from 120 million. The delta between GDP growth and population growth has been driven, in large part, by innovation. In addition, the value of listed corporations on U.S. stock exchanges at the end of 2020 was approximately $41 trillion, according to SIFMA, representing 38% of global equity market capitalization, while U.S. The current low level of interest rates and the relatively high level of the dollar both attest to the confidence that global investors have in the innovative U.S. economy.

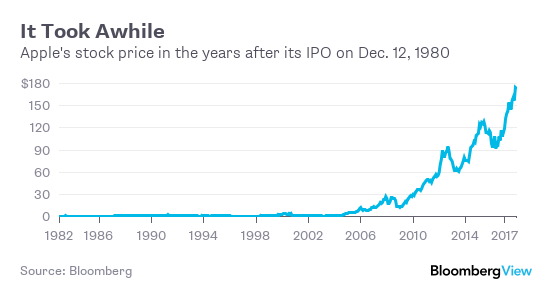

Now that you've got a brief overview of Apple and the stock's drivers, let's look at the current price. When analysing thebest shares to buy now, it's good to conduct some technical analysis on the share price. As you can see from the image below, Apple's price has recently pulled back and is now trading below the 50-day EMA. This moving average indicator gives a good representation of the trend – so the fact that Apple is below it is a bearish signal. Apple Inc. designs, manufactures, and markets smartphones, personal computers, tablets, wearables, and accessories worldwide. The company serves consumers, and small and mid-sized businesses; and the education, enterprise, and government markets.

It distributes third-party applications for its products through the App Store. The company also sells its products through its retail and online stores, and direct sales force; and third-party cellular network carriers, wholesalers, retailers, and resellers. Apple Inc. was incorporated in 1977 and is headquartered in Cupertino, California. 31 Wall Street analysts have issued "buy," "hold," and "sell" ratings for Apple in the last twelve months.

There are currently 1 sell rating, 5 hold ratings, 23 buy ratings and 2 strong buy ratings for the stock. The consensus among Wall Street analysts is that investors should "buy" Apple stock. View analyst ratings for Apple or view top-rated stocks.

Stocks were mixed on Friday morning as investors weighed strong earnings reports from major technology companies and positive consumer spending data. The Commerce Department said that U.S. consumer spending rose 5.6% in June, down from 8.5% in May, but above the Reuters consensus forecast of 5.5% growth. The Dow fell 0.5%, the S&P fell 0.1%, and the Nasdaq rose 0.7%. Crude oil rose slightly to $40 per barrel, while gold jumped $28 to $1970 per ounce. The U.S. Department of Commerce announced that its "third" estimate for 2Q20 GDP growth was a rate of 4.3%. This represents a return to more-normal GDP results after 30% swings down and up in 2Q20 and 3Q20.

This index, excluding food and energy, rose at a 1.3% pace, well below the Federal Reserve's inflation target of 2.0%. Although the economy has expanded for two quarters in a row, the National Bureau of Economic Research has not yet declared that the recession is over. At $21.49 trillion, the U.S. economy at the end of 4Q was still below its pre-pandemic highs of $21.75 trillion. These segments include consumer spending on durable and nondurable goods, and investment into residential and intellectual property products.

Other segments continue to lag, such as exports, consumer spending on services, and investment into structures. We anticipate a pick-up in economic growth in 2021, due in part to aggressive government spending. The U.S. Department of Commerce announced that its "third" estimate for 3Q21 GDP growth was a rate of 2.3%.

This was slightly above the previous estimates but in line with the consensus outlook. The growth rate, while positive, was more than 400 basis points below the 1H21 average of 6.5%, due to the emergence of the Delta variant of COVID-19. (The Omicron variant is also likely to have a negative impact on GDP in 2022, but we don't anticipate the impact will be as severe.) The GDP report also includes an inflation gauge, the PCE price index.

This index, excluding food and energy, rose at a 4.6% pace, well ahead the Federal Reserve's inflation target of 2.0%, but down from the 6.1% rate recorded in 2Q21. But there may be bumps along the way, including the impact of the Omicron variant on jobs and consumer spending on services, as well as supply-chain bottlenecks. Our forecast for 2022 GDP growth is 3.7%, compared to our estimate for 2021 GDP growth of 5.5%. Our final short-term Apple stock price prediction comes from the investment bank Goldman Sachs. In contrast to the sky-high forecasts from CNN Money and WalletInvestor, Goldman Sachs has a much more bearish prediction — and has ultimately given a sell rating for the stock. This surging trend points to Apple taking advantage of 5G technologies, offering users with superbly faster download times and allow a vast array of advanced technologies.

The iPhone sales have also strengthened demand for Apple's array of services. Such high-margin revenue streams would then fuel the tech giant's impressive earnings growth. Bullish investors are definitely excited about the possibility of greater profits, which beefed up Apple's stock performance that has reached all-time highs.

It is difficult to know what to make of iPhone sales forecasts. In early December, Goldman Sachs warned of slowing demand. A week later, Wedbush checked in with a higher price target tied to "robust" iPhone demand. Dan Ives indicated that iPhone demand in China is strong and that the company could sell 15 million iPhone 13 upgrades there and 40 million overall during the holiday season. Chip shortages have constrained supply, which has caused concern about lead times, however severe shortages that would affect sales do not seem to be coming to fruition.

The iPhone is still the straw that stirs the drink at Apple, so the results over the next two quarters will be critical to success in fiscal 2022. We have published our latest version of the Argus Millennial Generation portfolio. The intersection of important Millennial trends - sustainability, healthier living, an entrepreneurial spirit - has resulted in the emergence and growth of numerous companies well suited to the new generation.

Many of these companies are expected to be future industry leaders and are included in the dynamic Argus Universe of Coverage. A diversified portfolio, of course, is more than just a list of companies linked to themes. To build the Argus Millennial Generation Portfolio, we applied financial concepts such as industry diversification, income generation, risk reduction and growth at a reasonable price.

As we can see in the price chart above, the maximum Apple stock price prediction reported by CNN Money is $150. This would be a growth rate of 29.3%, smashing its previous ATH. Although the potential low is much more bearish (it clocks in at just $74.10), the CNN analysts agree that the AAPL stock is a strong buy — and they're not alone.